Introduction:

When you encounter such a problem like that happens in HDFC generally a people asked this common question to understand what the problem resembles. This “CC 000000XXXXXXX87657 autopay SI- TAD” which shows up in their statement, what is the problem, it’s an explanation and the complete fix.

This happens to those who own a credit card and this happens due to the outstanding amount that needs to be paid and it gets deducted from the main account i.e savings account.

What problem can be noticed in Autopay SI Tad?

CC followed by sixteen digits and autopay- TAD. If this is the exact problem you are facing, go through the article and I can explain the problem why is it happening and how you can easily detect and fix the problem.

However, it is said that the bank automatically sends an OTP as a message to the phone before deduction.

Also Read:

Problem explanation in brief

What is CC ?

CC, in brief, is Credit Card. This represents the credit card of your that you have an auto-payment on. A cc is also known as plastic money of its usability to transact funds anytime anywhere, this is issued by a bank as a credit to purchase or rent any type good.

What is this 000000XXXXXXX87657 mean ?

This is the credit card number that is issued by the bank and the amount deducted from the savings account is due to this credit card. The credit card can be identified by its last 5 digit number.

What is a autopay ?

Autopay is an automated system used in banks to pay off the bills on a specific time on monthly, yearly, or on a regular basis. A specific order is instructed by you to send a specific fund to an account in time.

What is SI in this problem ?

A SI, in brief, is Standing Instruction. A SI is also known as the Standing order which is an instruction given by the payer to the bank to pay a certain sum of amount to the payee from his/her savings/current account to the payee’s bank account.

However, standing instruction in the credit card means to be an automated payment system to pay off the loan or bill on a fixed time and a fixed amount. To get a clear idea you can visit ringgitplus where they have explained this in broad.

What is TAD ?

TAD in full form is Total Amount Due. The MAD is the minimum amount due i.e the bank prints in its statement about the MAD which is generally from 5% to 10%. And the total due is TAD. The minimum needs to be paid to continue with the service.

What the problem “CC 000000XXXXXXX87657 autopay SI- TAD” mean in total ?

The total problem means the Credit Card ending with 87657 is enabled for auto-payment as per your instructions from your bank account to pay the total due amount i.e TAD used for the credit card.

This also has the benefit of avoiding the interest that is payable if the credit card bill is due after the date. But because of this many consumers face nil bank balance, and the consumers may want to pay the balance later with interest or may pay them manually.

Many consumers complain that the bank automatically enables this auto-payment on its own and charge the consumers without sending any notification during the deduction. I will show you how to fix this problem.

How to stop autopay in HDFC PayZapp

Deactivate auto-pay using PayZapp

- Step-1 – Open the PayZapp App

- Step-2 – Enter the Pin and you will be securely logged in…

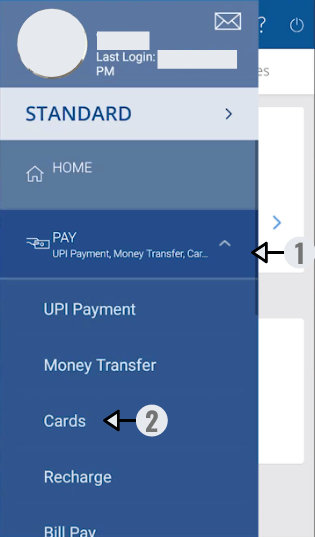

- Step-3 – Click the “Menu“option in the above and a slider will open

- Step-4 – A slider will open like this below screenshot.

1. Select the PAY option

2. Click the Cards option

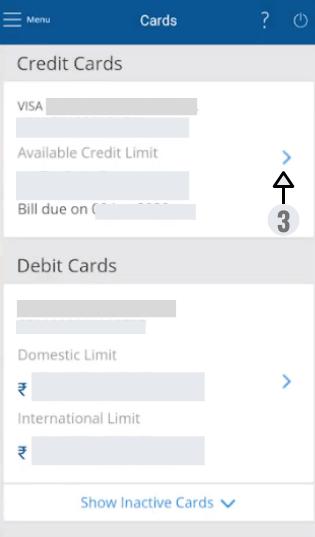

- Step-5 – A window will open that will show the list of credit card and debit card attached to your bank account.

1. Click the > button to open the Cards window

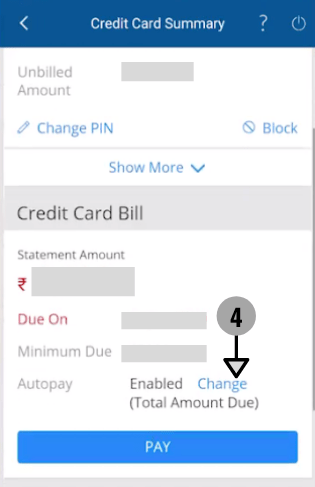

- Step-6 – After the Credit card summary opens, credit card details would be shown.

1. Click the Change button below the Credit card Bill Section

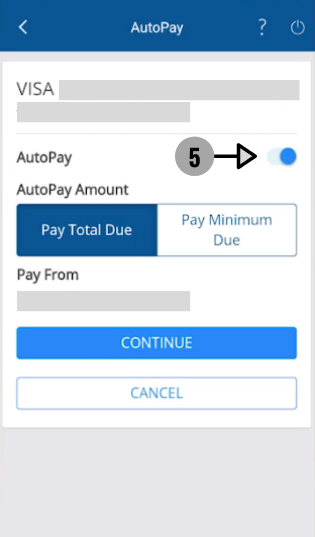

- Step-7 – In the screenshot below an Autopay named window will open up. The button will be turned on on default.

5. Click the button to deactivate.

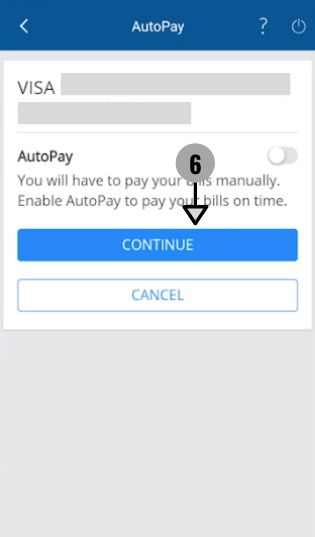

- Step-8 – After deactivation, it will look like the below screenshot.

6. Click on the CONTINUE option

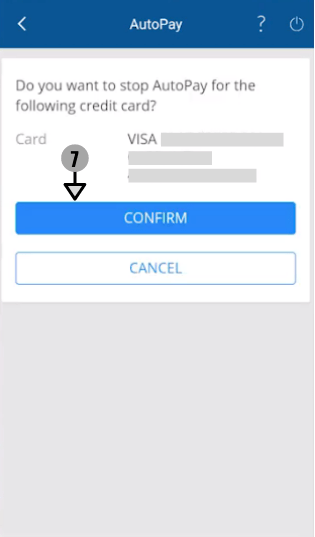

- Step-9 -Next this window would show up like the screenshot below.

7. Click the CONFIRM button

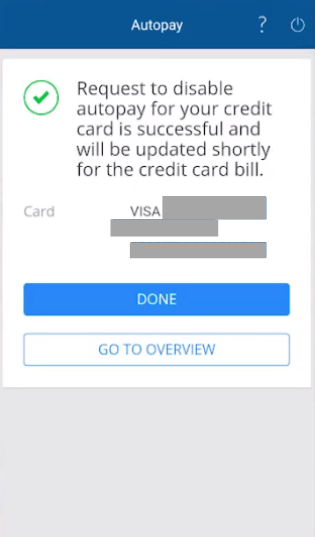

- Step-9 – All steps completed and the window will successfully display like the type of credit card and the card number.

Advantages

- Payments are processed automatically on time as selected.

- Automates Loans so no need to taken action manually.

- Avoids unnecessary interests charged by credit cards.

Disadvantages

- Manual transactions are slow but can be thoroughly checked.

- It has major drawback when in case it transacts automatically without sending OTP to the customer.

- You do not get the full customized control over the transactions will be going to happen.

Conclusion

In short activation can benefit you from outstanding balances that needs to be paid on time to avoid any fess attached to the future payments and interest charged by the bank. This ensures that you are free what you spend for and the charge will be deducted automatically.

However, if you just spend some thousands you choice may be different and you want to handle everything on your own and as because the bank don’t send you OTP or it empty your bank account that you have some thousands for emergency and you need to fill that up.

FAQ

Q. What is TAD and its full form?

TAD in full form is Total Amount Due. And as the full form clears the meaning that it is the total amount that is due on your credit card.

Q. What is MAD?

The MAD is the minimum amount due i.e the bank prints in its statement about the MAD which is generally from 5% to 10%. The minimum needs to be paid to continue with the service.

Q. What does autopay SI-TAD" mean?

This means that your credit card ending with xxxx something is enabled with Autopay feature which will automate your payments on time without any manual action. And it will show you the specific amount is deducted from your bank because of the due amount.

This feature may be enabled beforehand or maybe not but there's only fix is in this article to enable/disable.

Q. What is autopay si-tad means in hindi?

सरल भाषा में SI-TAD एक Banking App का feature है जिसके help से ऐप अपने लोन याह बिजली यह अलग बिल को भुगतान कर सकते हैं बिना उसके ऊपर समय दिए। ये automatic होता है जैसे ऐप timer सेट करता है। [Translated]

Refund