You must have seen people giving an blank cheque in movies, just a joke, but in case of Demand draft it’s rare to see as a ordinary people.

There are several ways including cash to transfer the money to other user’s hand but we gonna discuss the main highlights on the major difference between cheque and demand draft.

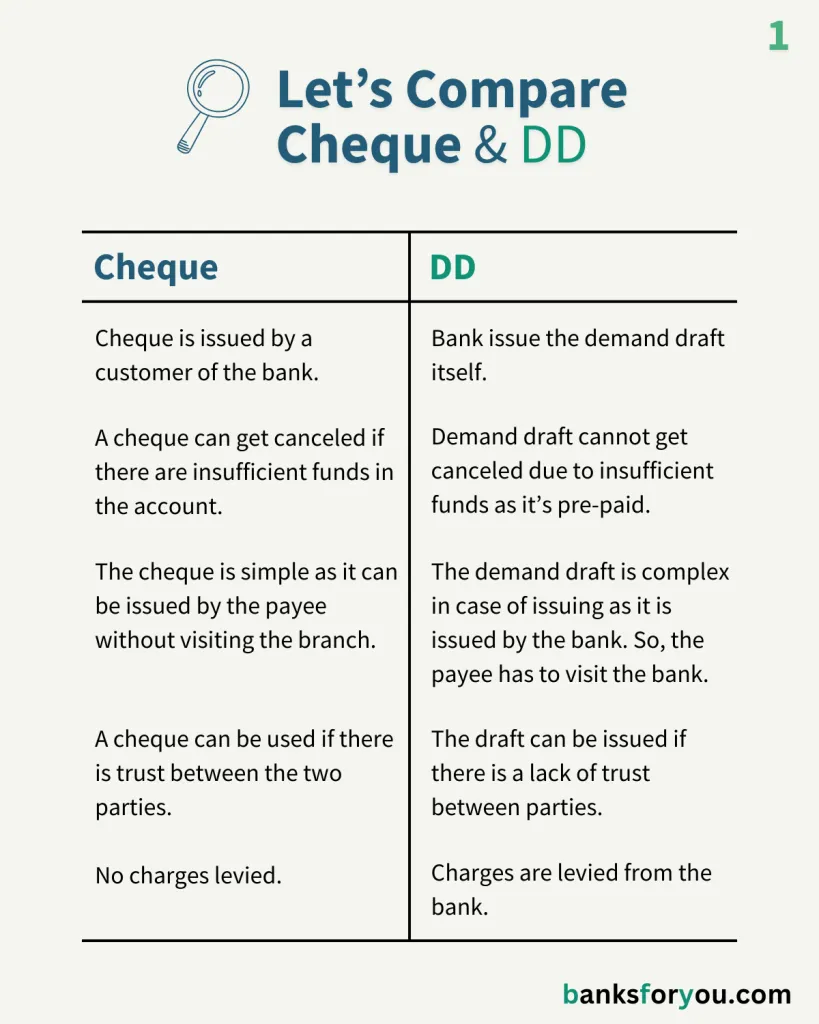

| Cheque | Demand draft |

| i) Cheque is issued by a customer of the bank. | i) Bank issue the demand draft itself. |

| ii) A cheque can get canceled if there are insufficient funds in the account. | ii) Demand draft cannot get canceled due to insufficient funds as it’s pre-paid. |

| iii) The cheque is simple as it can be issued by the payee without visiting the branch. | iii) The demand draft is complex in case of issuing as it is issued by the bank. So, the payee has to visit the bank. |

| iv) A cheque can be used if there is trust between the two parties. | iv) The draft can be issued if there is a lack of trust between parties. |

| v) No charges levied. | v) Charges are levied from the bank. |

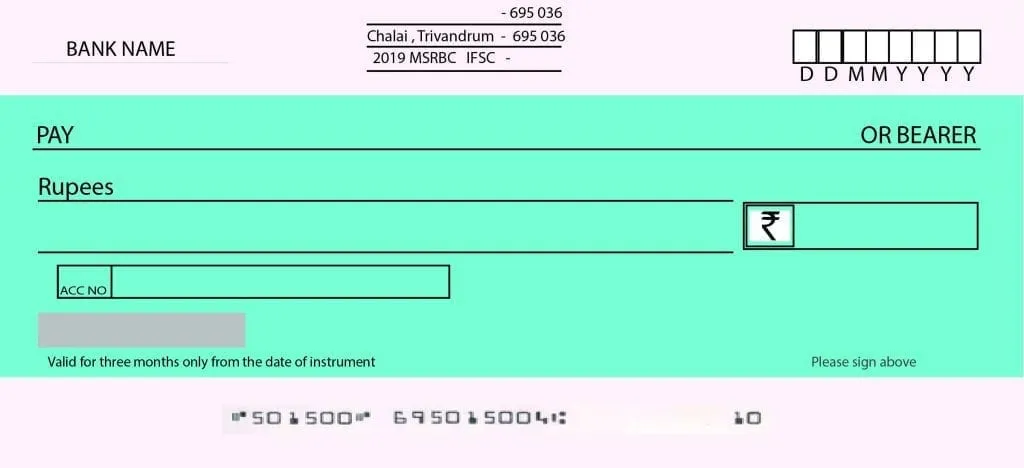

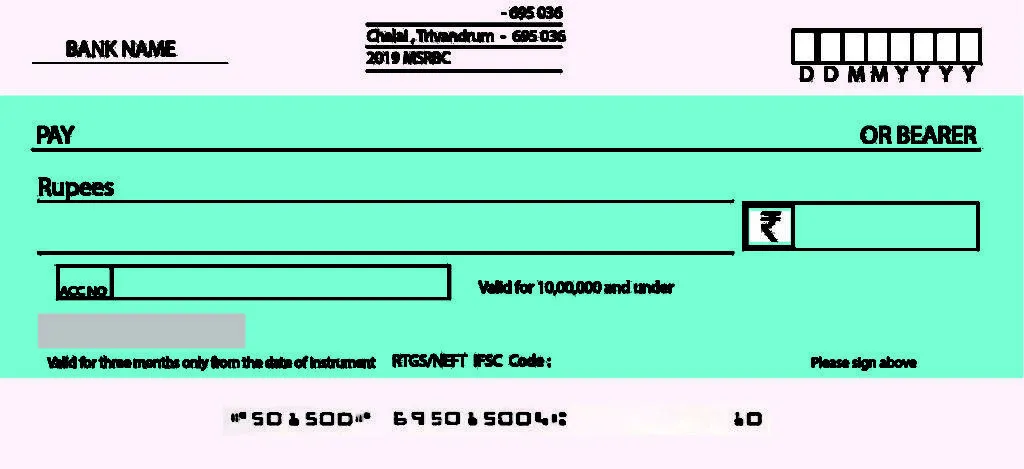

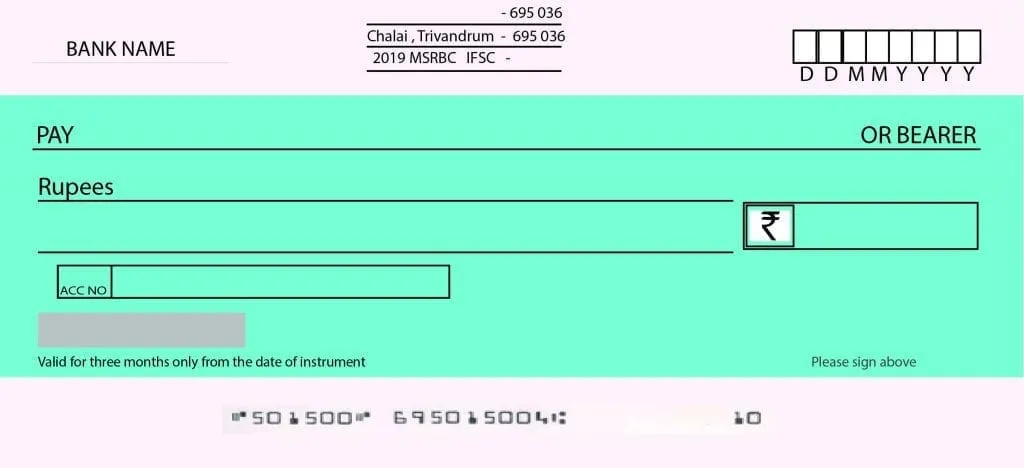

Definition of Cheque

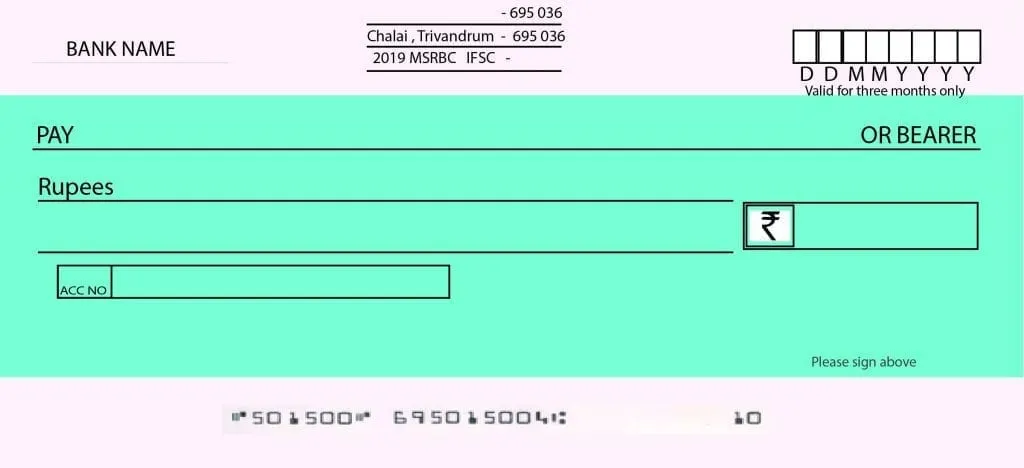

A cheque is a simple mode of payment which involves three parties such as:-

- The Drawer (the owner of the cheque)

- The Drawee (the bank expected to draw the cheque)

- The Payee (the party intended to receive the cheque)

It is issued by the user itself which deals with postpaid payment of often results in the bounce of cheque.

A cheque is said to be a blank cheque if it is already signed by the user beforehand but the price is to be written.

Many fraudsters, use a cheque to scam people or organizations.

Cheque has only a 3 months validity.

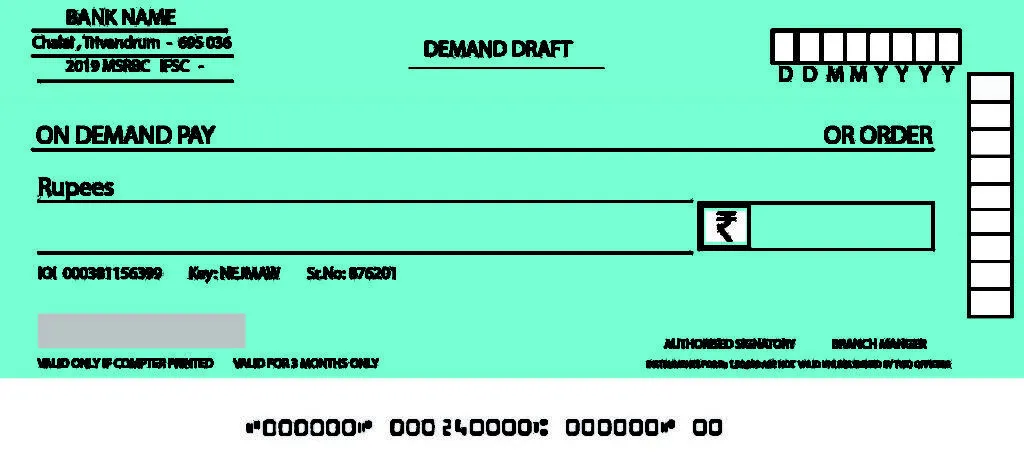

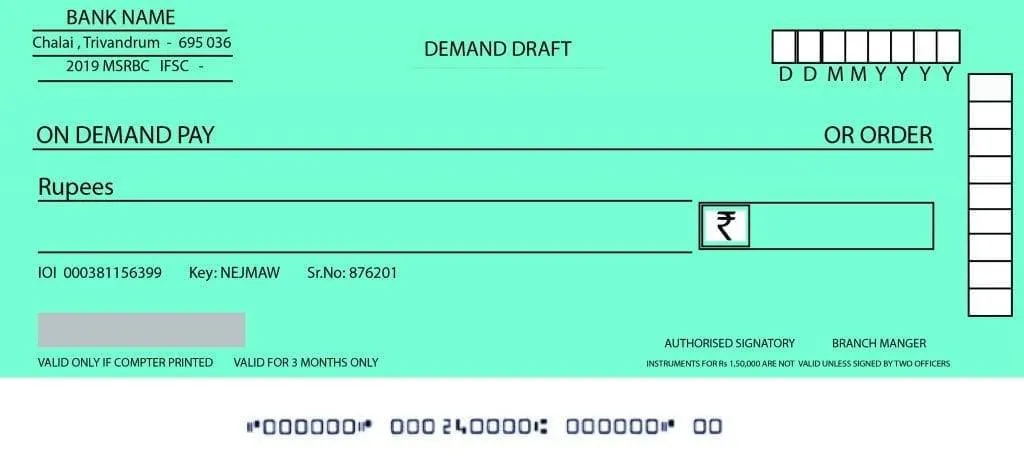

Definition of Demand draft

DD is often referred to as a demand draft.

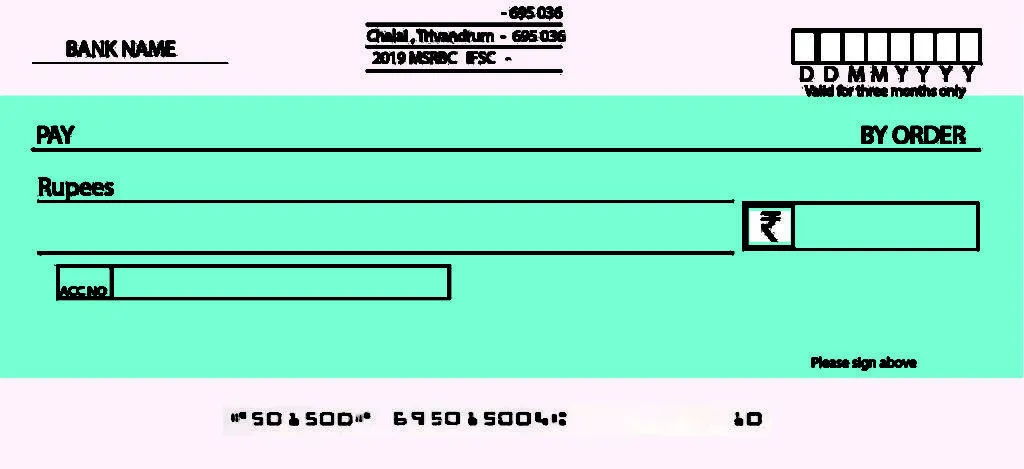

Demand draft is a mode of payment which involves two main parties:-

- The Drawer(The bank itself issue)

- The Payee(The party to be paid)

It is issued by the bank which deals with pre-paid payment which ensures extra protection and trust for the payee because the bank had already levied the money from the user bank account.

There is no option for the fraudsters to scam.

Demand Draft(dd) has a validity of 3 months from the issued date.

How to deposit dd in bank ?

You cannot encash a DD anymore! Banks have stopped giving cash against DD’s to prevent fraud cases.

Here’s what happens:

- The money will only get deposited into your bank account

- If it’s a Demand Draft from the same bank, it’ll clear in 1 business day

- If it’s from a different bank, wait for upto 3 business days max

Super important: Your name on the DD must exactly match your bank account name

But if you haven’t used the DD yet, you’ve got 3 options:

- Want to cancel it? Visit the issuing branch

- Lost it? You can request cancellation from the bank

- Already given it to the beneficiary? Nothing can be done – the bank has to make the payment

Bottom line – no cash in hand, money goes straight to your bank account!

Detailed Differences: 9 more comparisms

There are a lot more different types of difference between cheque and demand draft that might help you in the future:-

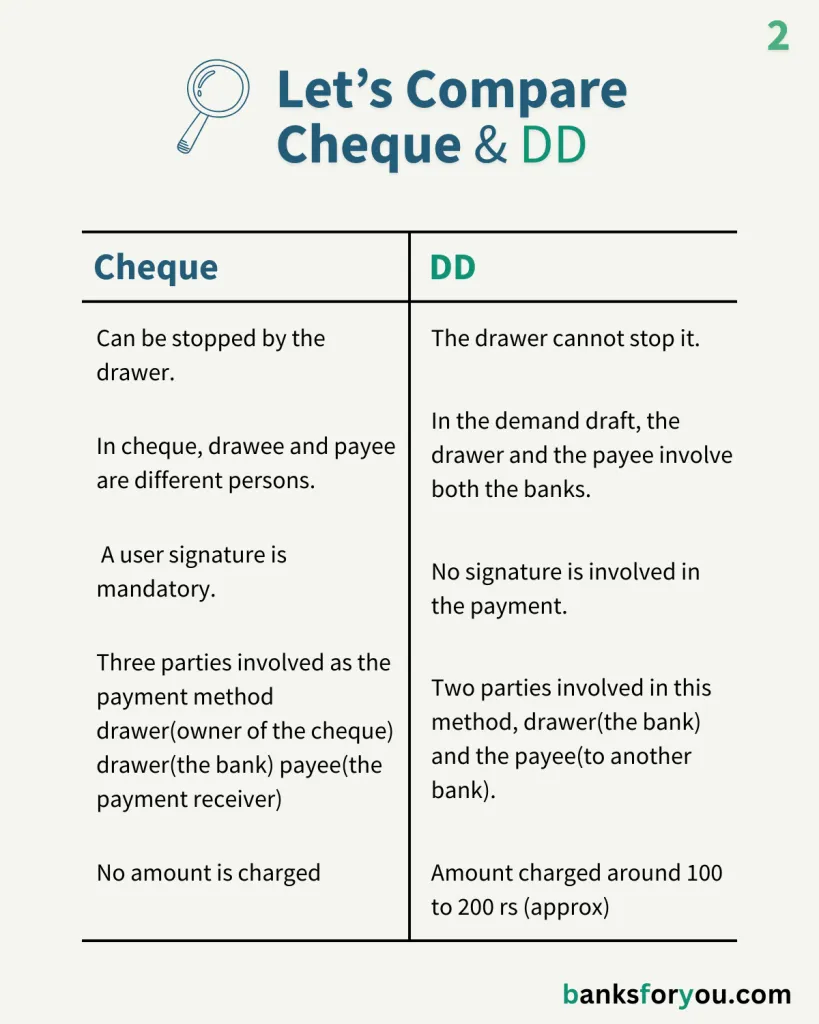

| Cheque | Demand draft |

| i) Can be stopped by the drawer. | i) The drawer cannot stop it. |

| ii) In cheque, drawee and payee are different persons. | ii) In the demand draft, the drawer and the payee involve both the banks. |

| iii) A user signature is mandatory. | iii) No signature is involved in the payment. |

| iv) The owner or the customer is the drawer. | iv) The bank itself is the drawer. |

| v) Three parties involved as the payment method drawer(owner of the cheque) drawer(the bank) payee(the payment receiver) | v) Two parties involved in this method, drawer(the bank) and the payee(to another bank). |

| vi) Only account holders of the bank can avail cheque book facility. | vi) Account-holders, along with non-account holders, can avail demand draft facility. |

| vii) The purpose of the cheque is to facilitate easy convenient and safely transfer money. | vii) The purpose of the demand draft facility. |

| viii) No amount is charged | viii) Amount charged around 100 to 200 rs (approx) |

| ix) It can be cleared on any branch of the same city. | ix) It can be cleared upon any branch of the same bank. |

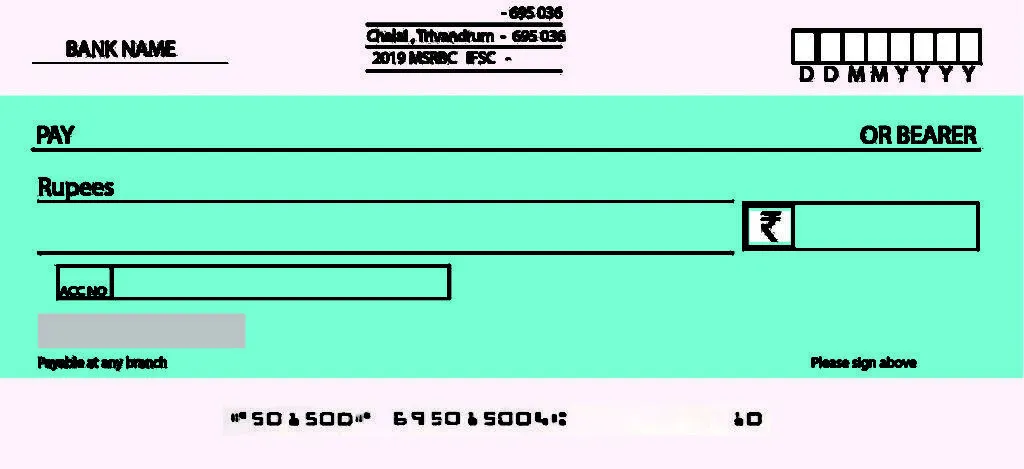

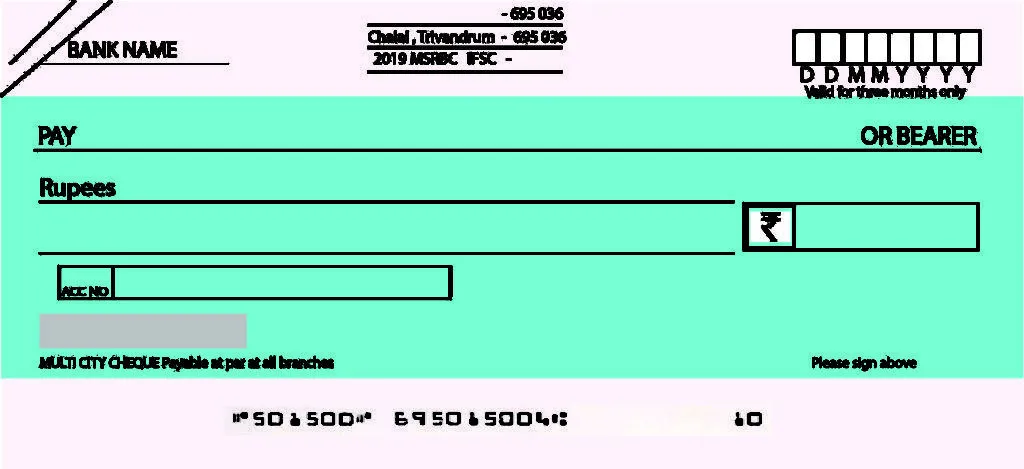

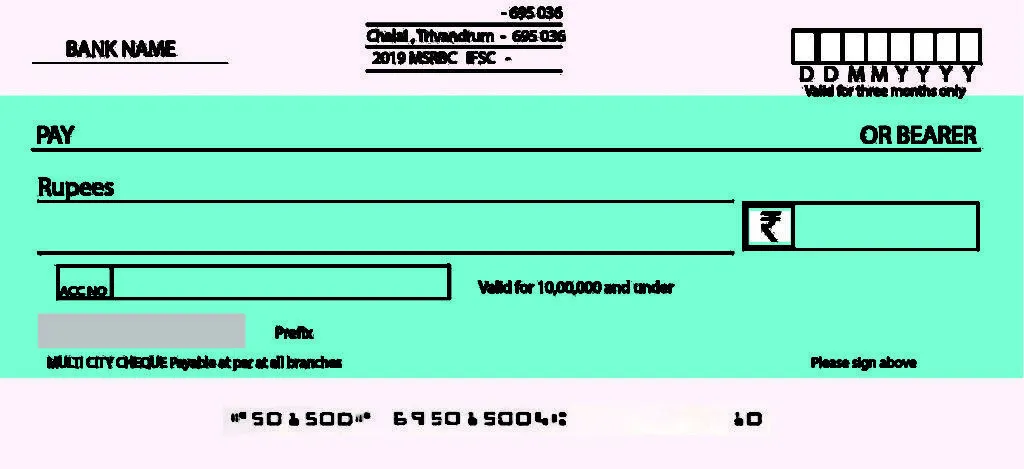

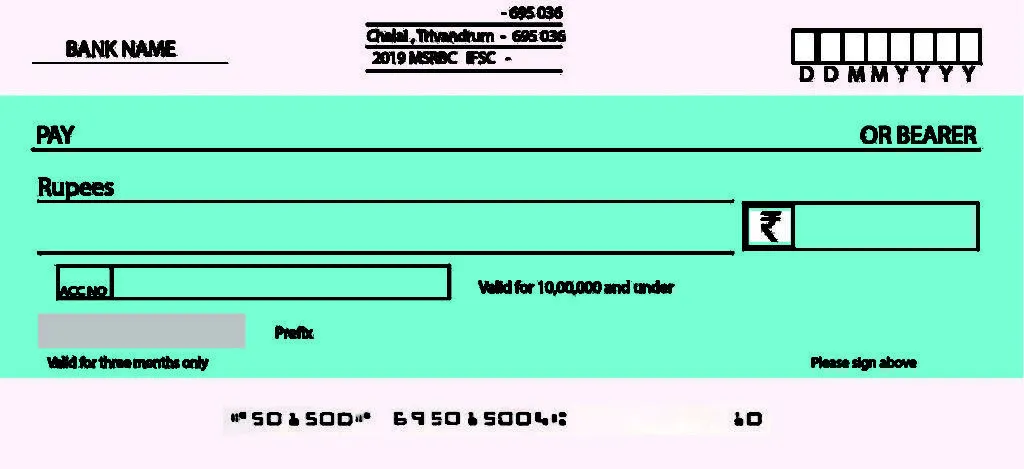

Types of cheque

Self cheque-

If ‘Self‘ is written on the cheque, it is considered as self cheque, which can be used for withdrawing money from owns bank to transfer money to any person or third party. They are highly exposed to threat as anyone can claim to withdraw funds.

Bearer’s cheque-

The word ‘bearer‘ is printed on the cheque. This cheque is applicable for everyone as, whoever bears the cheque can encash without any interruption. This is also not a safe method of payment as anyone can cash out money without the owner’s consent.

Order cheque-

This type of cheque can be used to pay a specific organization or a person. These cheques can be availed by the persons whose names specified in the cheque. The bearer part is not mentioned, so it makes a safer payment method.

Also, the payee has to bear some governmental identification to withdraw funds.

Pay-yourself cheque-

This is a different type of cheque used to buy drafts or orders by deducting from balance from the owner’s account.

Crossed cheque-

A cross cheque consists of two parallel cuts over the top left to signify its value separately for the bearer.

This is one step more secure cheque as this facility of withdrawing money is only available to the person whose name is written on the cheque and the fund can only be transferred to the payee’s bank account.

Post-dated cheque-

It can be en-cashed only after the time schedule mentioned in the cheque. Also known as pdc cheque. So even if scammers manage a cheque they cannot en-cash until and unless after the specific time.

Big transaction payments such as EMI’s are usually paid.

Stale cheque-

When drawer fails to provide within 3 months of validity or by some case the payee fails to en-cash within the time period, the cheque needs to re-validated with the full sign of the drawer so the payee can withdraw money.

Uncrossed cheque-

These open cheques can be transferred to the payee to his/her bank account directly. These cheques do not have the two parallel lines cut on the top left side of the cheque.

Mutilated cheque-

These cheques have an extra layer of security which protects the cheque from en-cashing by allowing the payee to withdraw money only after the approval of the drawer.

Types of demand draft

Sight demand draft-

This might be a secure payment method type in demand draft section as it provides the facility for the drawer as the payee has to present some document to the bank along with the draft.

Time demand draft-

This type of demand draft offers the drawer or the owner of the account to determine any specific time, at which the funds can be withdrawn within the time limit i.e. 3 months of validity. There is no change in image as both have the same demand draft paper even they differ in functions.

Conclusion

At last, next time when you visit a bank. Be sure to pick up any between two of the cheque and the demand draft. Make sure if you believe the other party whom you are transferring to is trusted and a good mutual understanding between two then go for “CHEQUE“.

But if you believe that the third party is not trust-worthy you can go for “DEMAND DRAFT” as also if the other party claims that too.

This is lastly a difference between cheque and demand draft. So as for now ending here. Or if you have any queries regarding this article you can contact us too.

Q. dd kya hota hai, draft meaning in hindi ?

dd को अक्सर डिमांड ड्राफ्ट के रूप में जाना जाता है। यह भुगतान का एक तरीका है जिसमें दो मुख्य पक्ष शामिल होते हैं:

i) The Drawer (बैंक खुद जारी करता है)

ii) The Payee (भुगतान पाने वाला पक्ष)

यह बैंक द्वारा जारी किया जाता है जो prepaid भुगतान से संबंधित है जो आदाता के लिए अतिरिक्त सुरक्षा और विश्वास सुनिश्चित करता है क्योंकि बैंक ने पहले ही उपयोगकर्ता के bank खाते से पैसे निकाल लिए थे।

Q. Does banks charge for cheque ?

Q. Demand draft meaning in tamil ?

dd பெரும்பாலும் கோரிக்கை வரைவு என குறிப்பிடப்படுகிறது. இது இரண்டு முக்கிய தரப்பினரை உள்ளடக்கிய பணம் செலுத்தும் முறையாகும்:

i) டிராயர் (வங்கியால் வழங்கப்பட்டது)

ii) பணம் பெறுபவர் (பணம் பெறுபவர்)

ப்ரீபெய்ட் கட்டணத்தை கையாளும் வங்கியால் இது வழங்கப்படுகிறது, இது பயனரின் வங்கிக் கணக்கிலிருந்து வங்கி ஏற்கனவே பணத்தை எடுத்திருப்பதால் பணம் பெறுபவருக்கு கூடுதல் பாதுகாப்பு மற்றும் நம்பிக்கையை உறுதி செய்கிறது.

Q. Can demand draft’s can be cancelled ?

Q. What is the validity of a cheque ?

Q. Demand draft meaning in bengali ?

dd প্রায়শই demand draft হিসাবে উল্লেখ করা হয়। এটি অর্থপ্রদানের একটি পদ্ধতি যা দুটি প্রধান পক্ষকে জড়িত করে:

i) ড্রয়ার (ব্যাংক নিজেই ইস্যু করেছে)

ii) প্রাপক (পেমেন্ট গ্রহণকারী পক্ষ)

এটি ব্যাঙ্ক দ্বারা জারি করা হয় যা prepaid payment নিয়ে কাজ করে যা প্রাপকের জন্য অতিরিক্ত নিরাপত্তা এবং বিশ্বাস নিশ্চিত করে কারণ bank ইতিমধ্যেই ব্যবহারকারীর ব্যাঙ্ক অ্যাকাউন্ট থেকে টাকা কেটে নিয়েছে৷

Q. Which is safer cheque or demand draft ?

Ans: In short, the cheque is safer for the issuer and the demand draft is safer for the third party.

Moreover, if something goes wrong the issuer can bounce check by keeping insufficient bank balance and on the other side, the third party can surely get the money if it uses demand draft.

Q. Demand draft meaning in kannada ?

dd ಅನ್ನು ಸಾಮಾನ್ಯವಾಗಿ ಬೇಡಿಕೆ ಡ್ರಾಫ್ಟ್ ಎಂದು ಕರೆಯಲಾಗುತ್ತದೆ. ಇದು ಎರಡು ಪ್ರಮುಖ ಪಕ್ಷಗಳನ್ನು ಒಳಗೊಂಡಿರುವ ಪಾವತಿಯ ವಿಧಾನವಾಗಿದೆ:

i) Drawer (ಬ್ಯಾಂಕ್ ಮೂಲಕ ನೀಡಲಾಗಿದೆ)

ii) Payee (ಪಾವತಿಯನ್ನು ಸ್ವೀಕರಿಸುವ ಪಕ್ಷ)

ಪ್ರಿಪೇಯ್ಡ್ ಪಾವತಿಯೊಂದಿಗೆ ವ್ಯವಹರಿಸುವ ಬ್ಯಾಂಕ್ನಿಂದ ಇದನ್ನು ನೀಡಲಾಗುತ್ತದೆ, ಇದು ಪಾವತಿಸುವವರಿಗೆ ಹೆಚ್ಚುವರಿ ಭದ್ರತೆ ಮತ್ತು ನಂಬಿಕೆಯನ್ನು ಖಾತ್ರಿಗೊಳಿಸುತ್ತದೆ ಏಕೆಂದರೆ ಬ್ಯಾಂಕ್ ಈಗಾಗಲೇ ಬಳಕೆದಾರರ ಬ್ಯಾಂಕ್ ಖಾತೆಯಿಂದ ಹಣವನ್ನು ಹಿಂಪಡೆದಿದೆ.

Respect to website author , some wonderful entropy.

Admiring the hard work you put into your website and in depth information you present. It’s great to come across a blog every once in a while that isn’t the same old rehashed information. Great read! I’ve bookmarked your site and I’m adding your RSS feeds to my Google account.

I feel that is one of the most significant info for me. And i’m glad reading your article. But wanna remark on few common things, The site style is wonderful, the articles is in point of fact great : D. Excellent task, cheers

Discovered this article involved, added to meemi

I feel that is one of the most significant info for me. And i’m glad reading your article. But wanna remark on few common things, The site style is wonderful, the articles is in point of fact great : D. Excellent task, cheers

Discovered this article involved, added to meemi

Admiring the hard work you put into your website and in depth information you present. It’s great to come across a blog every once in a while that isn’t the same old rehashed information. Great read! I’ve bookmarked your site and I’m adding your RSS feeds to my Google account.

Respect to website author , some wonderful entropy.

Thank you admin, this is wonderful article. Actually I like writing skills more than article.

hi sir, Thank for writing on this topic. This is very useful to me.