Yes, you can transfer money online. SBI and Union banks both are government banks but that doesn’t mean that you can only transfer to the government but also to the private, cooperative, and international bank.

Transferring money isn’t that hard if you follow the steps. Online transfer is secure, fast, and more efficient. And what I mean by efficient here is, to avoid visiting the bank branch.

Also here in SBI, you can also transfer funds using the ATM machine and branch using RTGS/NEFT form. But this article is for all the customers who are holding net-banking accounts of SBI and as all of their customers know how many people visit the SBI branch is massive.

Now before transfering funds you need to know how much money you want to transfer and in which method 3 are here –

- IMPS – Maximum amount can be transferred is up to 2 lack/day and is available 24*7 and charges are 0.

- RTGS – Maximum amount can be transferred up to 10 lack/day with a minimum amount of 2 lack/day must be transferred and charges are nil.

- NEFT – There is no bar in minimum and any starting amount can be transferred but with a limitation of up to 10 lack/day and charges are nil.

Now if you haven’t added your beneficiary you have to add it and wait for 4 hours until then you cannot transfer funds at least through RTGS/NEFT.

So before starting the transferring amount online let’s start with how to add the Union bank’s beneficiary to the SBI account and this also applies to any other bank.

How to add beneficiary to SBI’s online account ?

To transfer more than 10,000 Rs you need to add the beneficiary however if this is not your concern and you want to transfer funds under 10,000 chose the quick pay option that I will show next to this solution.

Already added Beneficiary skip to transfer method.

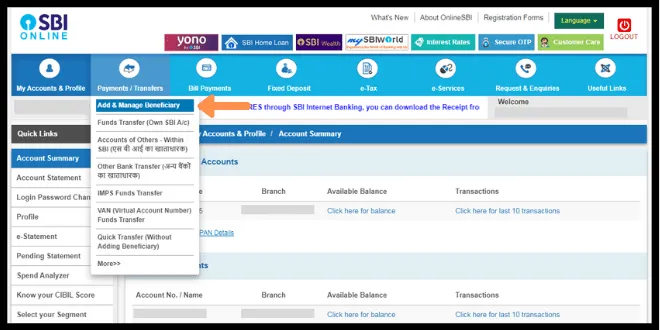

For now, start with logging into the SBI’s net-banking account then look for Payments/Transfers > Add & Manage Beneficiary

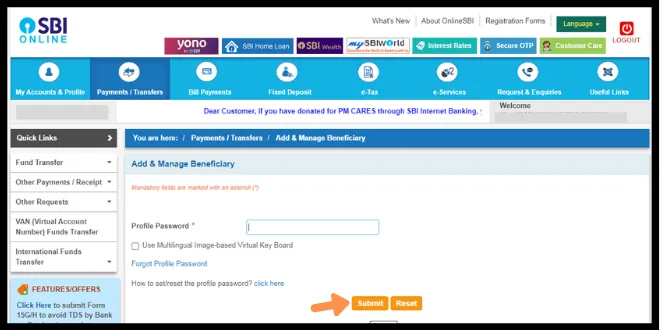

Now enter the profile password to enter the profile section and then click on Submit.

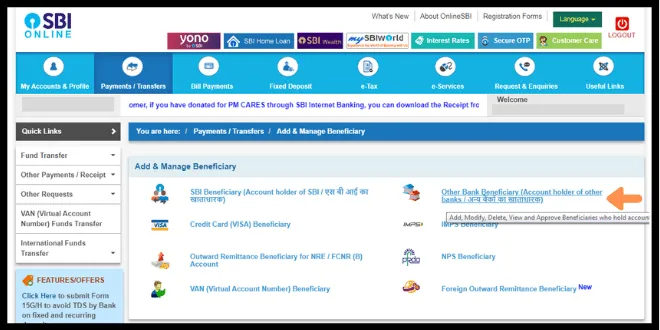

Now a page with Add & Manage Beneficiary will open up where you can find 8 options, look for Other Bank Beneficiary (Account holder of other banks /…..) click on the option.

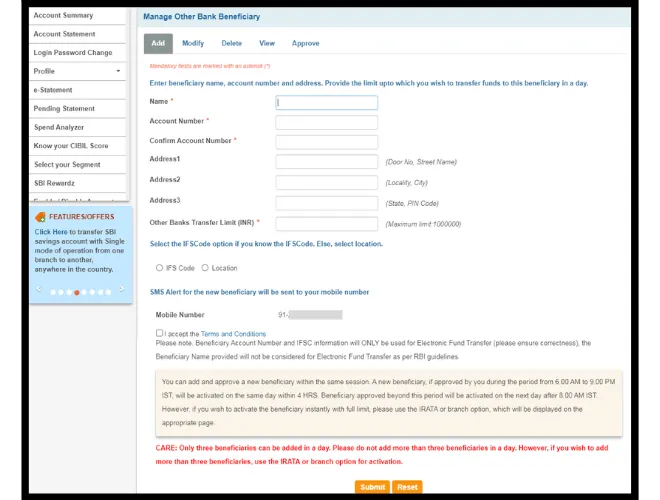

Now a page with many details to be filled will be opened up don’t worry every detail will be elaborated.

Start with the full name of the fund receiver then the account number twice in first and in confirm field.

Next Address write the same address as given in his/her passbook ask for it however this is not mandatory you can skip this.

- In Address1 write the street address.

- In Address2 write the city or village name.

- In Address3 type the pin code.

Now in Other Banks Transfer Limit (INR) enter the amount up to which you will transfer in the future however this limit is /day basis.

Now select the IFS code or Location, Any one.

In the next line, your bank-lined number will be shown as shown in the screenshot below. Click on the I accept button and lastly click on the Submit button.

Now after adding the beneficiary wait for 4 hours until that you cannot send money to the beneficiary. After that follow the below steps to send any amount of money and as per your choice select any among the 3 – RTGS/NEFT/IMPS

How to transfer money online from SBI to union bank ?

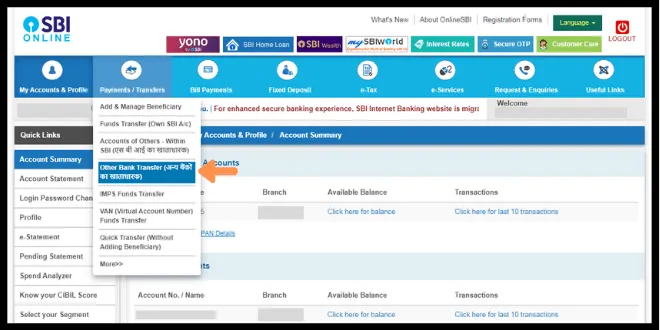

After logging into the dashboard now look for Payments/Transfers > Other Bank Transfer, click on it.

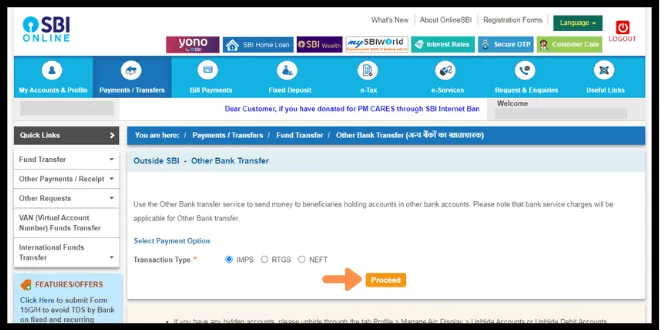

After clicking the previous option, three options will be shown as IMPS-RTGS-NEFT as shown in the below screenshot however it entirely depends on the customer that how much amount he/she wants to transfer to the beneficiary’s account.

| Criteria: | RTGS | NEFT | IMPS |

|---|---|---|---|

| Minimum limit: | 2 Lakh | Rs 1 | Rs 1 |

| Maximum limit: | upto 10 Lakh/day | upto 10 Lakh/day | upto 2 Lakh/day |

| Charges (online): | Nil | Nil | Nil |

| Availability: | Mon-Fri:Sat 7:00 – 18:00 | Mon-Fri:Sat 7:00 – 18:00 | 24*7 availability |

| Waiting: | 1-2 Hours | 30 Minutes | Immediately in no time. |

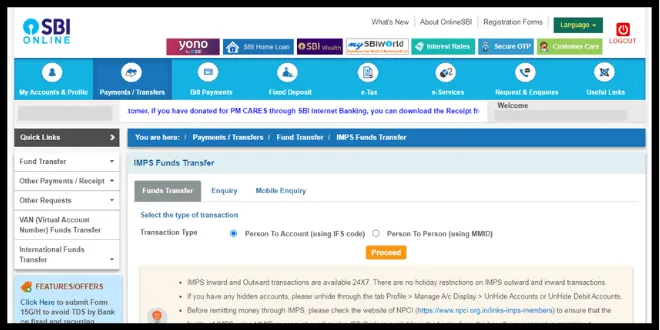

Now between these options here I am choosing Person to Account (using IFS code) as this option suggests that a customer can transfer the funds directly to the account. Lastly, click on the Proceed button.

Now please read the following carefully:

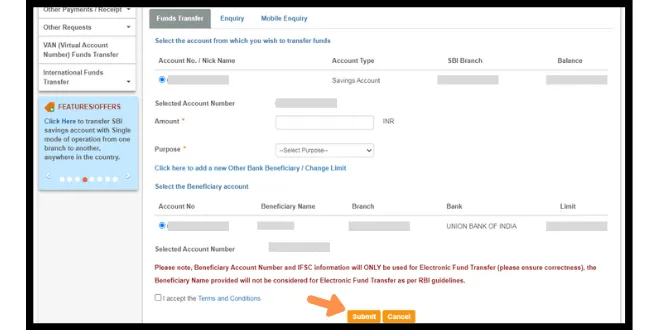

The first bank account is the SBI’s account and if you want to transfer from other SBI’s account select that if you have more than one account, it will appear.

Now the selected SBI account is shown where fill the Amount in digits that you want to send to the beneficiary account(Union bank account in this case). After that select any Purpose you want as these two fields are compulsory.

Now the beneficiary that you’ve added will be shown at the last where the bank name will also be shown. Now select the account to which you want to transfer funds. Click on I accept.

Lastly click Submit button to transfer.

Now if you want to transfer funds below 10,000 Rs there is an option in SBI that can transfer without adding a beneficiary to the account. Now I am going to discuss this process to ease your life.

How to transfer money online without adding beneficiary ?

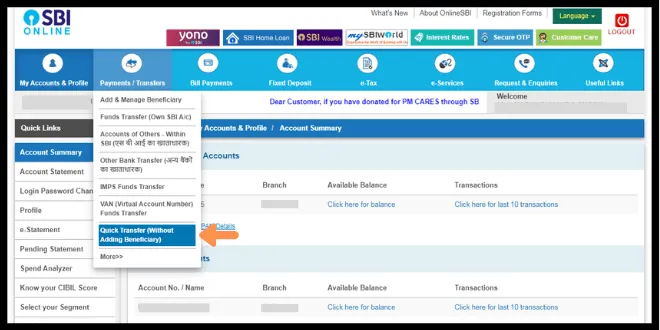

Now after logging into the SBI online account hover over to Payments/Transfers > Quick Transfer (Without Adding Beneficiary), click on it as shown in the below screenshot.

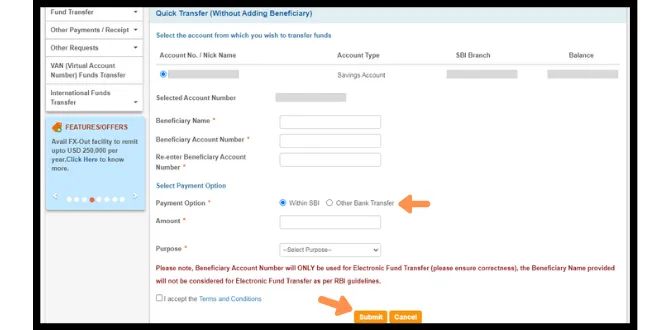

The SBI’s account will be shown at the top just like you can see in the screenshot below or if you have more than 1 account select anyone.

Now in Beneficiary Name, type the full name, write account number twice. Now click on the Other Bank Transfer if you want to transfer funds to other accounts.

Enter the Amount in digits you want to transfer. Also, select any Purpose from the list. Lastly, click on the I accept option and Submit button.

FAQ:

Q. How can I transfer money from SBI to other banks online?

Ans- Follow the below steps-

1. Payments/Transfers > Other Bank Transfer.

2. Select any among IMPS, RTGS, NEFT, click proceed.

3. Select Person to Account however you can choose MMID too, click proceed.

4. Now fill the Amount, Purpose, and click on I accept and Submit button.

Q. How can I transfer money from SBI to Ubi?

Ans- Not only specified to UBI but the process for transferring is the same for all banks. Here is the elaborated article.

Q. Are there any charges for transferring funds in SBI?

Ans- No there are no charges for transferring funds for the online transfers but there are bank branch charges.

Q. How to transfer money online SBI without adding a beneficiary?

Ans- There is an option for Quick Pay which is offered by SBI to its customers for transferring funds online without adding beneficiary but the fund transfer is limited up to 10,000 Rs only.

However, let me discuss the process.

1. Hover over to Payments/Transfers > Quick Transfer (Without Adding Beneficiary)

2. Now fill the Beneficiary Name, fill the beneficiary account twice.

Select Other Bank Transfer.

Then enter the Amount, and select the purpose.

Click on I accept and the Submit button to transfer.

Best Banking Blogs i’ve ever found so far over Google

Many thanks for sharing such wonderful article