Cheque writing is the most headache task to send money because even RTGS/NEFT/IMPS aren’t that hard to understand and have less tension regarding fraud. Nowadays, UPI is spreading over the country India which is developed by NPCI.

When writing many rules and some kind of guidelines you may say are told over the surface by the RBI that is also called Guidelines.

However, if you don’t have a clear idea on the cheque you can check this article on cheque and come back here again to read it’s guidelines.

Introduction: Write as per rules

Do you know that a single space on the cheque can ruin you? How I will tell you in this article more in detail share some of the mistakes you do or might in future that I am here to save you, your money from getting fraud.

Not only because of your security but for the cheque truncation system which was introduced in India, 2008. And this system involves electronic transfer of cheque through imaging.

This means if you write wrong information or follow a bad pattern of writing your cheque might get rejected and dishonored cheque can cost you more than you think from the degradation of CIBIL score to a case on you.

Even you may know all the guidelines to follow to make sure this time your cheque doesn’t bounce and create a trouble for you –

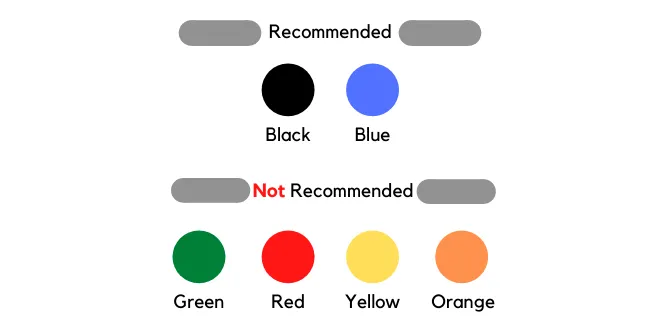

#1st Rule: Colour

The first thing that everyone forgets or ignore is the pen colour to be used. Yes! This is also the most important thing to notice and change that you cannot use any colour that you like. I have a dedicated article on why shouldn’t you use any colour for writing a cheque ? check that out.

So what to use, black or blue even that has a controversial part so do check the article out that I suggested and you can decide more easily. But why shouldn’t you because using any different colours can fade away like the red pen it’s unclear for an imaging machine to scan and send to the central system.

This can reject your cheque from clearing and it does as some of the banks have in rule and if you are writing a cheque in a bank branch, the bank employees will restrict this.

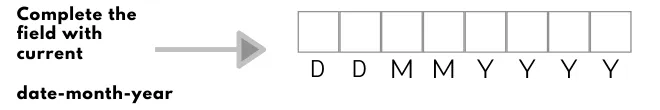

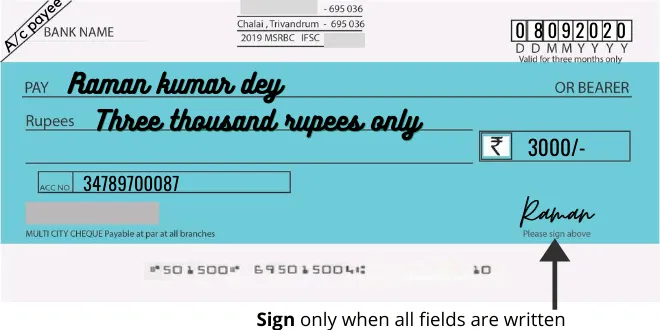

#2nd Rule: Date

In the right section of the cheque, a Date field and some of the customers forget to put a date. Why this date field matters because without this your cheque will get rejected. The date field in boxes must be written in numbers.

Write as per the date/month/year, to precisely follow the rule of writing the current date of writing the cheque so there would be no problem during cheque clearance. Many times, giving the advance dates can cause cheque bounce because of low balance in the account that had been used before a cheque clearance.

So, use this formulae of writing the current date when you are writing the cheque.

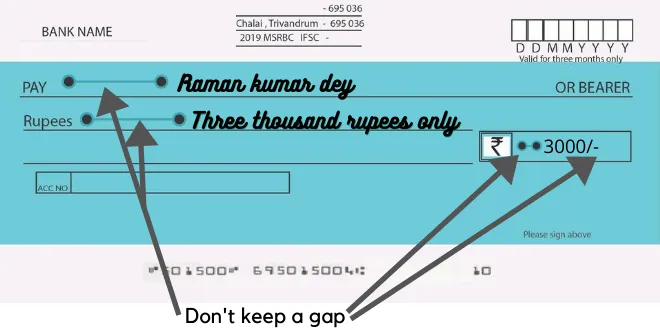

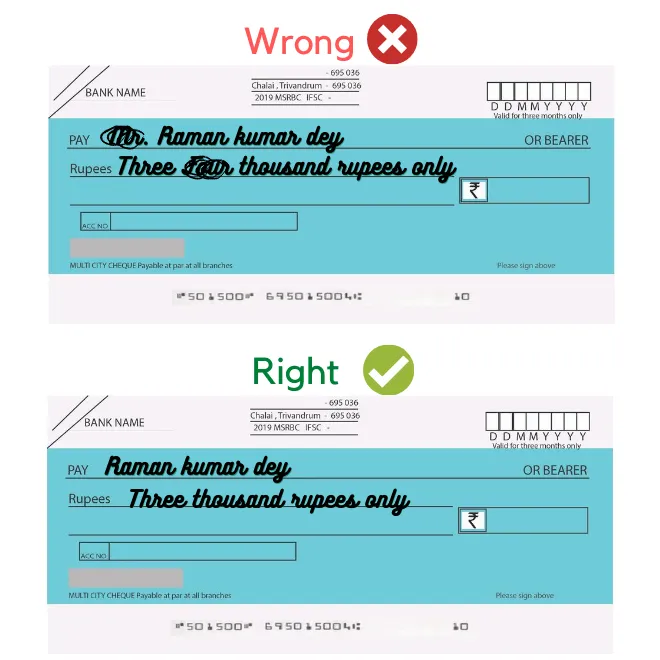

#3rd Rule: Gapping

This needs to be discussed before everything begins because the gap can cause a loophole in your cheque like anyone can add anything before your payee name, amount.

And you know the next how much it can cause you financially.

#4th Rule: Pay

The next field where Pay is written, the name of the payee must be written. Many of them, ask a question on should I write a cheque in a capital letter, small letter or letter case and the letter case is OK. This means the first one is capital and others are small.

Now coming back to the point, the name must be written correctly otherwise even a missing or adding of a word can cause cheque to be bounced. The name must be the same as the account of the payee.

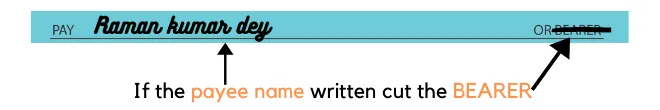

At last, simply cut a straight line over the BEARER word to avoid encashing of the cheque, the BEARER means whoever is bringing the cheque can encash the cheque.

#5th Rule: Amount

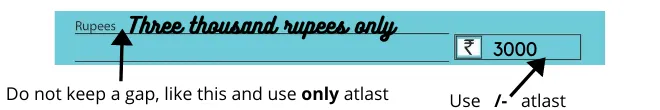

Covering both the rupees in words and numbers sections to keep it simple and compact. While writing in words, don’t keep a huge gap between the Rupees and your first word, for example, check if the gap isn’t sufficient for anyone to write between them. In the last add ‘only’ so there’s no possibility of any fraud.

The next field with an amount in numbers should be written exactly as you have written in words and now in numbers, use a /- at the last to avoid adding any numbers for anyone.

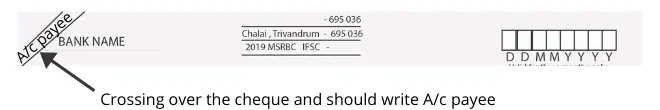

#6th Rule: A/C

This might be common for the users who use crossed cheque and it is often said a good practice to cross over the top and write “A/C payee” to make it clear for the cashier or the in-charge to not to encash it to the bearer but to the payee’s account directly even without the bearer being cut.

This is not mandatory but a good practice to have while writing cheques.

#7th Rule: No rewrite

If all the fields are correctly written check once and if there is a requirement for a rewite that means cutting the current words or anything that needs a little correction, cancel the whole cheque and move onto the next fresh new cheque.

This is done because a rewritten cheque with cut other than bearer is considered as the cheque is being used by any other person and it gets rejected by the bank to avoid any kind of fraud transaction.

So, do not cut and write, rather use a new one.

#8th Rule: Signature

Instruction, where a signature is done only at the last, is the best practice. Signature is the most important part of a cheque, without this, your cheque will not be cleared.

Do not sign all the blank cheque that you have in the checkbook and that is wrong because anyone can later write the amount and payee over the cheque with your sign, can encash easily.

Sign only above your printed name which is located at the bottom-right section of the cheque.